Dlaczego kolorowe diamenty są tak cenne?

Przez wieki diament był oznaką władzy, bogactwa i statusu społecznego. Starożytni Grecy cenili niezniszczalny kamień i wierzyli w jego mistyczną moc. Na przestrzeni wieków diamenty były noszone przez władców, członków rodzin królewskich i najbardziej wpływowych ludzi świata. Nie wszystkie diamenty są jednak tak samo cenne. Kamienie o odpowiedniej jakości są bardzo rzadkie, a ich unikalny charakter determinuje cenę. Do najbardziej pożądanych i drogocennych należą kolorowe diamenty. Dlaczego te kamienie są tak cenne?

Spadające wydobycie wyjątkowych diamentów

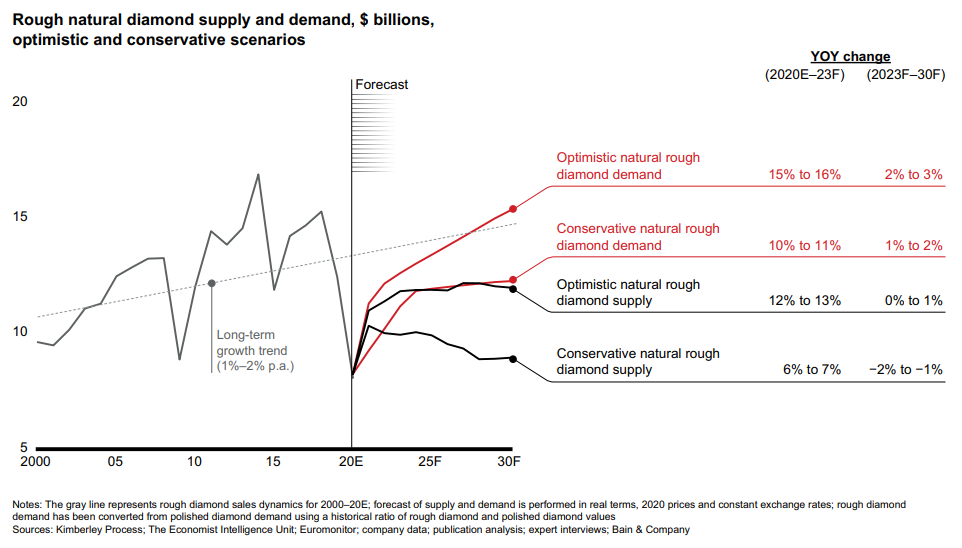

Wykres 1. Prognoza podaży i popytu

Nie każdy diament to dobra inwestycja

Nie wszystkie wydobywane diamenty mają jednak dużą wartość. Firma konsultingowa Bain & Co. szacuje, że około 40% wydobywanych diamentów, ze względu na swoją jakość i niewielki rozmiar, wykorzystuje się w przemyśle. Z punktu widzenia jubilera i inwestora nie mają one wartości. Kolejne 40% stanowią diamenty o jakości zbliżonej do jakości jubilerskiej. Podobnie jak kamienie wykorzystywane w przemyśle, te o jakości zbliżonej do jubilerskiej, nie są wykorzystywane w jubilerstwie i nie mają potencjału inwestycyjnego. Tylko pozostałe 20% wydobywanych kamieni nadaje się do oprawienia w biżuterię lub inwestowania. Odrzucając bardzo małe kamienie (poniżej 0,4 karata), zostaje około 5% diamentów o odpowiedniej jakości. Wśród tych kamieni znajdują się diamenty bezbarwne oraz kolorowe.

Czy kolorowe diamenty są wyjątkowe?

Diamenty bezbarwne są dość powszechne, stanowią prawie całe wydobycie. To diamenty kolorowe są bardzo rzadkie. Nie ma dokładnych danych, jeżeli chodzi o strukturę wydobycia poszczególnych kolorów, ale na rynku diamentów powszechna jest opinia, że na wydobyte 1 000 karatów diamentów bezbarwnych przypada 1 karat diamentów kolorowych (0,1%). Niektórzy podają nawet, że jest to 1 kamień na 10 000 wydobytych. Im rzadszy jest diament, tym jego cena jest wyższa.

Należy podkreślić, że nie wszystkie diamenty nadają się do oprawiania w biżuterię lub inwestowania. Kamienie, które spełniają te warunki, są bardzo rzadkie. Większość z nich stanowią diamenty bezbarwne. The Fancy Color Research Foundation szacuje, że tylko 3% diamentów, które trafiają do laboratoriów certyfikujących, to diamenty kolorowe.

Kamień, który ma unikatowe cechy, będzie silniej pożądany. Większe zainteresowanie przełoży się na wyższą cenę. Najrzadsze wśród diamentów, diamenty kolorowe, będą zatem najcenniejsze. W odróżnieniu od bezbarwnych bardzo trudno (graniczy to wręcz z niemożliwością) jest znaleźć dwa takie same diamenty. To dodatkowo podnosi ich wartość.

Najpopularniejsze diamenty kolorowe

Najbardziej popularne są żółte diamenty. Szacuje się, że stanowią 76% wydobycia wszystkich diamentów kolorowych. Jak podaje FCRF najczęściej na rynek trafia diament (dane FCRF zawsze dotyczą kolorowych diamentów o masie powyżej 1 karata) o intensywności Fancy Light, czystość VS, masie 1 – 1,50 karata w kształcie poduszki (cushion/radiant). Rocznie takich kamieni pojawia się około 1 300 – 1 700. Ich cena waha się od około 3 tys. USD/ct do 4,7 tys. USD/ct u sprzedawców detalicznych. Widełki cenowe wynikają z tego, że każdy diament jest inny.

Cena wynikająca z jakości

Na cenę kamienia wpływają: barwa (color), czystość (clarity), masa (carat) oraz szlif (cut), czyli 4C. Najbardziej wartościowe diamenty kolorowe będą miały bardzo intensywne barwy (intensity).

Diamenty powstały głęboko pod ziemią, pod wpływem ekstremalnego ciepła oraz ciśnienia. W wyniku tego procesu praktycznie każdy kamień jest zanieczyszczony. Zanieczyszczenia mogą mieć różną intensywność. Dzielimy je na wewnętrzne (inkluzje) oraz powierzchniowe (skazy z ang. blemishes). Czystość odnosi się do stopnia, w jakim występują te niedoskonałości.

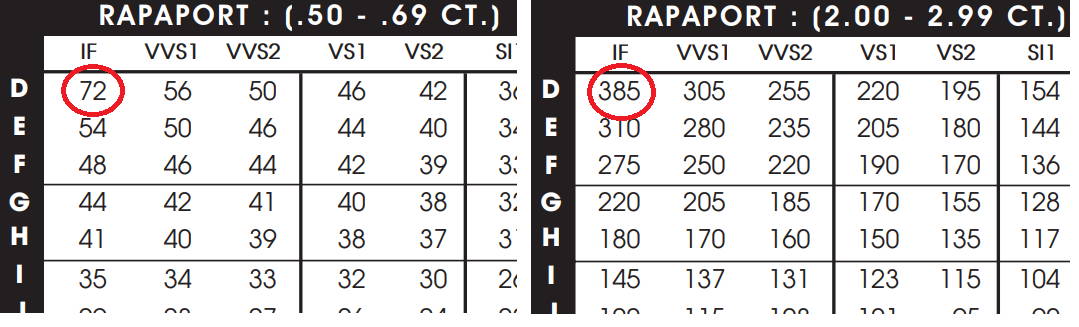

Diamenty o większej masie są cenniejsze. Przy tych samych parametrach większe kamienie o określonej masie (np. 2 ct) są więcej warte, niż kilka kamieni mniejszych o tej samej łącznej masie (np. 0,5 + 0,7 + 0,8 ct).

Tabela 1. Wybrane ceny diamentów bezbarwnych

Źródło: Rapaport

Wyższa cena diamentów kolorowych

Żółty diament o intensywności Fancy Light, czystość VS, masie w przedziale 2 – 2,99 karata w kształcie poduszki, będzie bardziej unikatowy niż diament bezbarwny o tych samych parametrach. Rocznie na rynek trafia jedynie około 230 -290 podobnych kamieni. Mniejsza dostępność znacząco wpływa na cenę. U sprzedawców detalicznych waha się ona między 3,3 tys. USD/ct, a 6,4 tys. USD/ct. To pokazuje, że masa kolorowych kamieni ma bardzo duże znaczenie. Wzrost masy o 1 karat przekłada się na wzrost ceny o 10 – 36% za karat. Większe dysproporcje będą zachodzić przy większych kamieniach. Przy tych samych cechach, ale masie w przedziale 3 – 3,99 karata, cena za karat żółtego diamentu u sprzedawców detalicznych wynosi 4,3 tys. USD/ct do 7,3 tys. USD/ct. Cena wynika z ich bardzo unikalnego występowania. Na rynek trafia rocznie tylko 180 – 240 takich diamentów.

Tabela 2. Wpływ unikalności na cenę diamentu

Źródło: FCRF

Deficyt różowych diamentów

Rocznie na rynek trafia bardzo niewielka ilość kolorowych diamentów. Najczęściej są to kamienie o żółtym kolorze, które stanowią około ¾ rocznego wydobycia kolorowych diamentów. Najrzadziej spotykane są niebieskie i różowe diamenty, które stanowią odpowiednio 0,5% i 5% wydobycia. Ich cena będzie odpowiednio wyższa od kamieni żółtych. Szczególny jest przypadek różowych diamentów. Z powodu zamknięcia kopalni Argyle w Australii, skąd pochodziło 90% wszystkich różowych diamentów na rynku, popyt na nie wielokrotnie przewyższy podaż. Silnie ograniczona dostępność nowych kamieni będzie dodatkowym czynnikiem determinującym wyższą cenę.

Unikalność diamentów kolorowych

Najbardziej popularny, wśród trudno dostępnych niebieskich diamentów, jest 1 – 1,50 karatowy kamień w kształcie poduszki (cushion/radiant) o czystości IF, VVS, lub VS i intensywności koloru Light, lub Fancy Light. Niebieskie diamenty o takich parametrach trafia na rynek raz na 1-2 lata a ich cena na rynku detalicznym to nawet 100 tys. USD za karat. Diamenty o większej masie, powyżej 2 karatów trafiają się raz na 5-6 lat. Kamienie powyżej 11 karatów pojawiają się raz na 25 lat lub rzadziej.

Podobnie kształtuje się specyfika rynku różowych diamentów. Na rynku wtórnym, ceny różowych diamentów od kilku lat dynamicznie rosły. Do najczęściej pojawiających się na rynku różowych kamieni należał 1 – 1,50 karatowy w kształcie poduszki (cushion/radiant) diament o intensywności Fancy Light i czystości VS. Rocznie trafia na rynek od 23 do 27 takich kamieni. Ich cena na rynku detalicznym waha się między 62, a 66 tys. USD za karat. Cenę mocno podnosi wspominana wcześniej likwidacja największej kopalni różowych diamentów w Argyle.

Najdroższe diamenty świata

Tak naprawdę diamenty nie są rzadkim kamieniem. W porównaniu do innych kamieni szlachetnych są jednymi z najbardziej popularnych. Mimo powszechności diamentów te, które nadają się do wyrobów jubilerskich lub jako aktywa do inwestowania są bardzo rzadkie. Większość wydobywanych kamieni, ze względu na swoje cechy, nadaje się jedynie do przemysłowego wykorzystania. Jedynie około 20% może zostać użyta do produkcji wyrobów jubilerskich. Dlatego nie wszystkie diamenty są wartościowe i drogie.

Kolorowe diamenty są bardzo rzadko spotykane. Jedynie co tysięczny karat wydobywany na świecie jest kamieniem kolorowym. Do najbardziej unikatowych, wśród kolorowych diamentów, należą te o barwie niebieskiej i różowej. Z powodu nieczęstego występowania ich ceny są bardzo wysokie. Popyt na nie ciągle rośnie, głównie wśród konsumentów z Azji i Ameryki Północnej, a podaż sukcesywnie spada. Rosnąca luka popytowo – podażowa oraz unikatowy charakter mocno napędza cenę.

Kamienie o odpowiedniej jakości są rzadkie, a rzadkość diamentu determinuje cenę.

Tabela 3. Rzadkość występowania wybranych diamentów

Źródło: FCRF

05.09.2021r.

Autor: Aleksander Matusiewicz

Porozmawiajmy

Ponad 10 lat doświadczenia w handlu diamentami, dedykowany Dział Analiz oraz zespół ekspertów w biurach w całej Polsce pozwalają nam zapewnić naszym Klientom niezrównane wsparcie na każdym etapie procesu pozyskiwania diamentów - od wyboru właściwego kamienia po jego sprzedaż z zyskiem. Zapraszamy do rozmowy telefonicznej oraz spotkania z nami osobiście lub online.

Najnowsze artykuły